![]() Check us out on Facebook. (here)

Check us out on Facebook. (here)

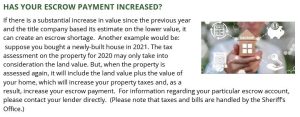

Our office often receives questions about escrow accounts. Generally, it is the practice of title companies to estimate initial escrow figures based on the last available tax bill.

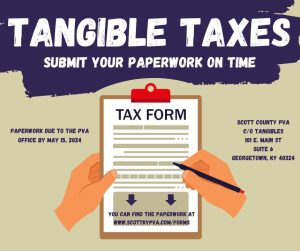

All individuals and business entities who own or lease tangible property located in Scott County on January 1st, 2024, must file a tangible property tax return by May 15th, 2024. You can find the paperwork at our website under the “Downloadable Forms” tab.

All individuals and business entities who own or lease tangible property located in Scott County on January 1st, 2024, must file a tangible property tax return by May 15th, 2024. You can find the paperwork at our website under the “Downloadable Forms” tab.

Do you ever wonder who maintains a specific street?

Our friends over at Planning and Zoning have a guide to help you determine the answers to those questions. Just click the link below and look for the street/s in question and you can see who is in charge of maintaining those.

**************************************************

ARE YOU OR SOMEONE YOU KNOW, 65 OR OLDER?

ARE YOU OR SOMEONE YOU KNOW, 65 OR OLDER?

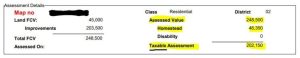

Did you know, if you are 65 or older, or 100% Disabled and own your own home, you may qualify for the Homeowners/Disability exemption to help with your taxes.

To see if you qualify, click here for more information.

*************************************************

IS YOUR MAILING ADDRESS CORRECT?

If you moved or purchased a property this year we may not have your correct mailing address. SO….go to PROPERTY SEARCH, type in the property address and verify the owners mailing address is correct. If it isn’t, give us a call at 502-863-7885.

Click Here!